Results & Highlights

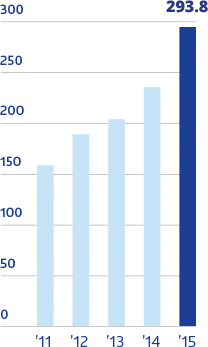

Revenue

($)

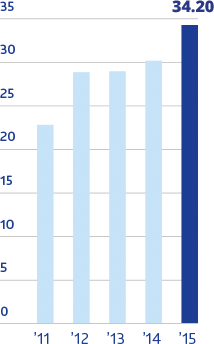

Underlying

Cash NPAT

($)

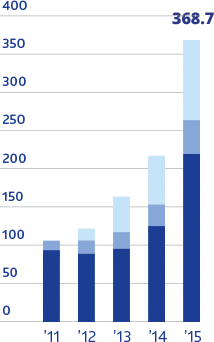

Gross

Receivables

($)

Commercial Leasing

Consumer Leasing

Consumer Rentals

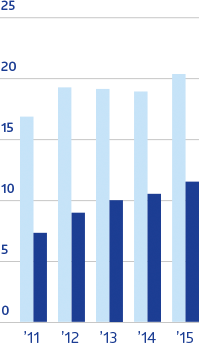

EPS

& DIVIDENDS

(cents)

Basic Earnings Per Share

Dividends Paid Per Share

FINANCIAL HIGHLIGHTS

REVENUE

UP

$293.8M

25.1%

Underlying cash NPAT

UP

$34.2M

13.6%

Reported NPAT

UP

$30.6M

8.5%

Group Receivables Up To

68.1%

$368.7M

Roe

Return on equity

Return on equity

18.9%

FULL YEAR, FULLY

FRANKED DIVIDEND

FRANKED DIVIDEND

11.75¢

OPERATIONAL HIGHLIGHTS

- Record installations and earnings in consumer leasing

- Consumer finance building receivables strongly across all loan products

- Significant organic growth in commercial finance

- Strategic acquisition of cash resources australia

- Diversification strategy producing higher results and strong receivables growth